Understanding the Wood County, WV Tax Map: A Comprehensive Guide

Related Articles: Understanding the Wood County, WV Tax Map: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the Wood County, WV Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Wood County, WV Tax Map: A Comprehensive Guide

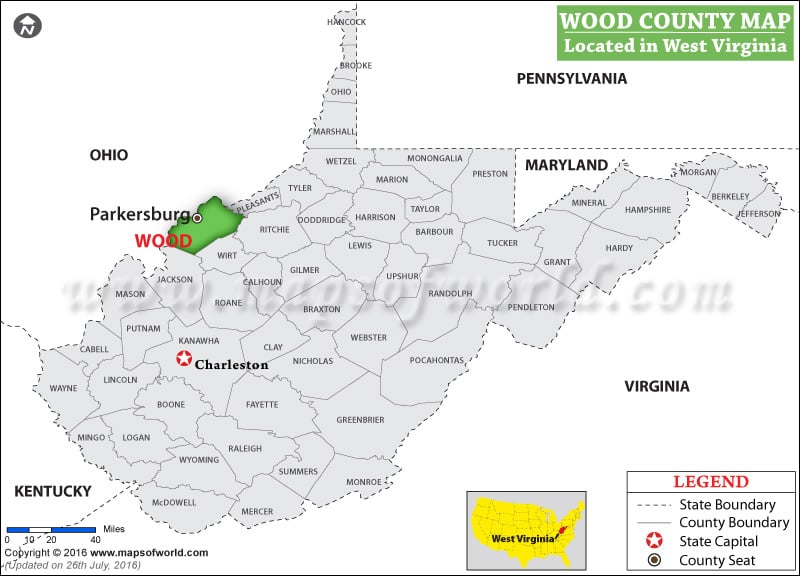

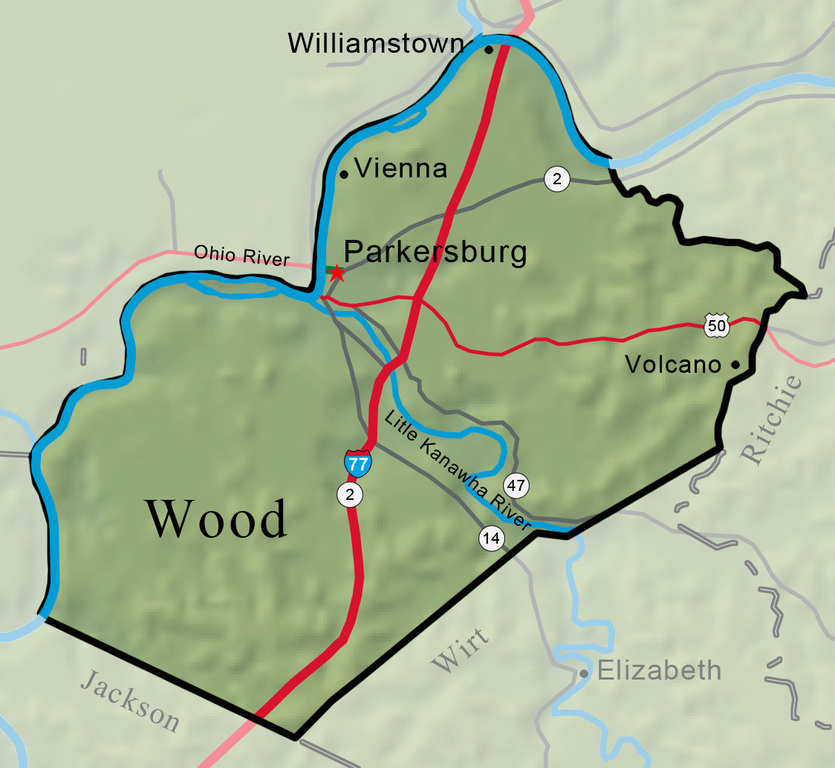

The Wood County, WV Tax Map serves as a vital tool for understanding and navigating property ownership and taxation within the county. It provides a visual representation of all parcels of land, offering detailed information about each property and its associated tax details.

Delving into the Details: What Information Does the Tax Map Contain?

The Wood County Tax Map is a valuable resource for various stakeholders, including:

- Property Owners: Provides clarity on the boundaries of their property, its assessed value, and associated tax obligations.

- Potential Buyers: Offers insights into the size, location, and tax status of properties they are considering purchasing.

- Real Estate Professionals: Facilitates accurate property valuations and assists in understanding market trends.

- Government Officials: Enables efficient tax assessment, collection, and property management.

The information contained within the tax map typically includes:

- Parcel Number: A unique identifier for each property.

- Property Address: The legal address of the property.

- Owner Name: The legal owner of the property.

- Property Type: Residential, commercial, industrial, agricultural, etc.

- Land Area: The size of the property in acres or square feet.

- Assessed Value: The estimated market value of the property for tax purposes.

- Tax Rate: The current tax rate applied to the property.

- Tax Liability: The total amount of taxes owed on the property.

Accessing the Wood County Tax Map: Available Options and Resources

Several methods allow individuals and organizations to access the Wood County Tax Map:

- Online Portal: The Wood County Assessor’s website often provides an online portal where users can search for specific properties by address, parcel number, or owner name.

- Public Records: The Wood County Assessor’s office typically maintains physical copies of the tax map, accessible to the public during business hours.

- Real Estate Professionals: Real estate agents and brokers often have access to the tax map through various databases and software programs.

Benefits of Utilizing the Wood County Tax Map

The Wood County Tax Map offers numerous benefits, including:

- Transparency and Accountability: Provides a clear and accessible record of property ownership and taxation, promoting transparency and accountability in government operations.

- Property Valuation and Assessment: Enables accurate property valuations, ensuring fair and equitable tax assessments for all property owners.

- Land Use Planning: Assists in understanding land use patterns and identifying areas for development or conservation.

- Economic Development: Provides valuable insights into property ownership and land availability, supporting economic development initiatives.

Frequently Asked Questions (FAQs)

Q: How can I find my property on the Wood County Tax Map?

A: The Wood County Assessor’s website typically offers an online search function, allowing users to locate properties by address, parcel number, or owner name. Alternatively, you can visit the Assessor’s office during business hours to access physical copies of the tax map.

Q: What is the purpose of the assessed value on the tax map?

A: The assessed value represents the estimated market value of your property for tax purposes. It is used to calculate your annual property tax liability.

Q: How can I appeal my property assessment?

A: If you believe your property’s assessed value is inaccurate, you can file an appeal with the Wood County Board of Review. The Board will review your appeal and make a final decision on your property’s assessed value.

Q: What is the difference between the tax map and the property deed?

A: The tax map provides a visual representation of property boundaries and tax-related information. The property deed, on the other hand, is a legal document that establishes ownership and outlines the rights and responsibilities associated with the property.

Q: How can I obtain a copy of my property deed?

A: You can obtain a copy of your property deed from the Wood County Clerk’s office. They typically charge a fee for providing copies of official records.

Tips for Navigating the Wood County Tax Map

- Familiarize Yourself with the Map: Spend time exploring the tax map and understanding its layout, symbols, and terminology.

- Utilize Online Resources: Take advantage of the Wood County Assessor’s website and online portals for easy access to property information.

- Consult with Professionals: If you have any questions or require assistance navigating the tax map, consider seeking guidance from a real estate professional or legal expert.

- Keep Records: Maintain copies of your property tax bills, assessment notices, and other relevant documents for future reference.

Conclusion

The Wood County Tax Map serves as a vital resource for understanding property ownership, taxation, and land use within the county. It provides a comprehensive overview of properties, facilitating informed decision-making for property owners, buyers, real estate professionals, and government officials. By leveraging the information available through the tax map, individuals and organizations can navigate property transactions, manage tax obligations, and contribute to responsible land use planning within Wood County, WV.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Wood County, WV Tax Map: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!